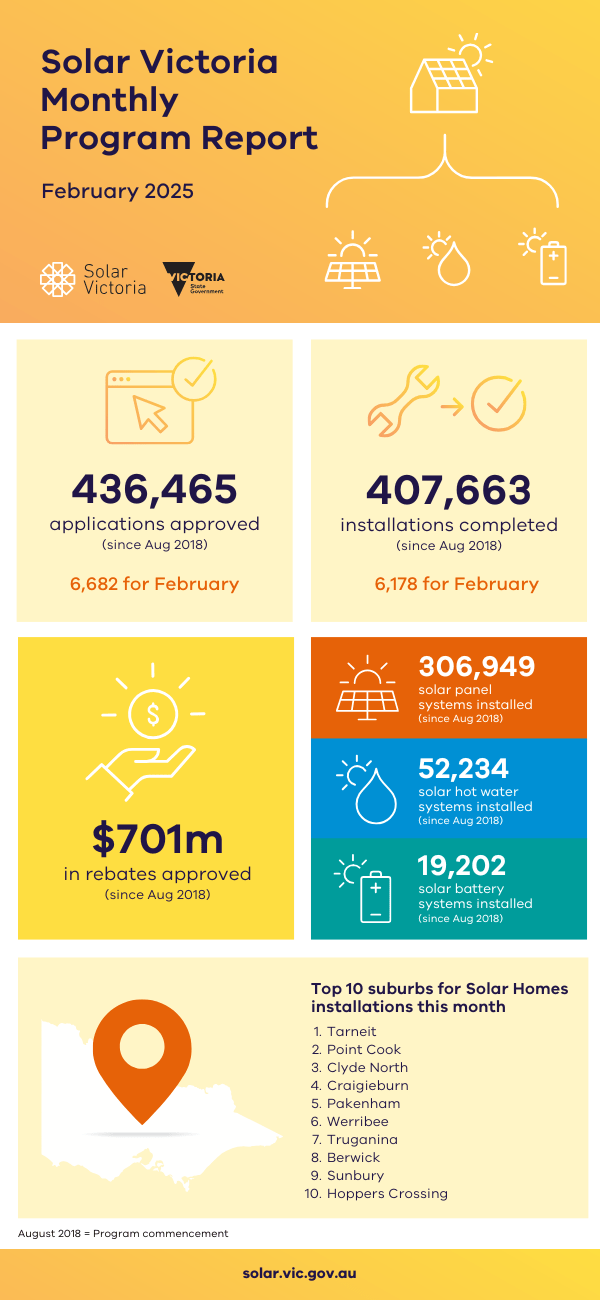

Monthly infographic

Approved applications by authorised retailer (2025)

The tables below contain a monthly record of the approved applications for each Solar Retailer participating in the NETCC program.

Retailer Battery (Owner Occupier) Hot Water (Owner Occupier) Solar PV (Landlord) Solar PV (Owner Occupier) 0CARBON 0 5 0 0 1KOMMA5 Sydney and Melbourne 0 0 0 7 1Power Solar 1 0 0 6 1 Solar Australia 0 0 0 2 365 Solar Australia 1 2 0 10 3 Phase Solar Pty Ltd 0 1 0 3 3P Solar 6 0 1 87 4Shaw Plumbing 0 3 0 0 60 Shades 0 1 0 0 A1 Solar & Electrical Gippsland 0 4 0 0 Abacus Energy 0 0 0 1 Abacus Solar 0 0 0 5 Accredited Power Saver 0 75 0 0 Active Energy Group 2 0 0 1 ACW Plumbing & Gas Fitting PTY LTD 0 1 0 0 Adopt Solar 0 0 0 15 ADSA Australian Solar 0 0 0 1 Advanced Energy Management 0 2 0 10 Advanced Energy Solutions 0 1 0 1 Advanced Solar & Batteries 2 0 0 5 Advantage Solar 0 0 0 42 Agas Plumber 0 1 0 0 Agility Solar 0 0 0 2 AGL Solar 1 0 0 1 Alee Solar and Electrical Services 0 0 0 1 All Electric Homes 1 10 0 6 Allemand Electrical 0 0 0 1 Alliance Solar 0 0 0 7 ALLIANCE SUNPOWER 0 0 0 1 ALL PLUMBING CONNECTIONS 0 1 0 0 All Points Energy Solutions 1 0 0 0 Alpex Electrical 0 0 0 1 ALR Designs Pty Ltd 0 0 0 2 Amazing Solar Solutions 4 0 0 85 Amazon Energy 0 0 0 2 AME KURTA PTY. LTD. T/A Jims Energy 0 1 0 14 Ampforce Solar Pty Ltd 1 0 0 1 Amrut Solar 0 0 0 1 ANB Plumbing 0 1 0 0 Andrew J Robertson Plumbing 0 1 0 0 Apex Global Solutions 0 0 0 5 Apex Plumbing Bright 0 1 0 0 Arinna Solar 0 0 0 2 Arkana Energy Group 7 0 0 15 ARKG Trading Pty Ltd 0 1 0 18 Aruonergy 1 0 0 1 Ashcroft Electrical 0 0 0 3 Astronic Solar 0 0 0 4 Ausceylon Solar 0 0 0 2 Ausielectricals Pty Ltd 0 0 0 1 Auspro Group 0 4 0 0 Aussie Ecomarks 0 2 0 0 Aussie Greenmarks 0 20 0 0 Austech Electrical and Plumbing Services 0 40 0 2 Australian Climate Systems 0 3 0 0 Australian Design Solar Pty Ltd 0 0 0 11 Australian Energy Upgrades 0 14 0 0 Australian Green Solution 0 216 0 0 Australian Renewable Investments 0 0 0 1 Australian Solar and Energy Solutions 0 1 0 8 AU SUN SOLAR 0 1 0 0 AUZBRIGHT 0 39 0 0 AVM Electrical 0 0 0 2 AZ Solar 0 0 0 8 BaileyTech Solar & Electrical 1 0 0 3 Bairnsdale Electrical & Solar 0 2 0 0 Ballarat Essential Plumbing 0 2 0 0 Ballarat Hot Water and Plumbing 0 3 0 0 Ballarat Plumbing Services 0 1 0 0 Ballarat Solar Company 1 0 0 2 Ballarat Solar Panels 0 0 0 2 Bascon Solar Solutions 0 0 0 2 BD NORTH EAST ELECTRICS PTY LTD 1 2 0 2 Begbie Electrical 0 2 0 0 Bespoke Solar 1 2 0 1 Beston Group (VIC) Pty Ltd 0 1 0 0 Betta Value Renewable Energy 0 0 0 18 Billabong Solar 1 0 0 9 Binu Electrical Services PTY LTD 0 0 0 1 BJ White Electrics 1 2 0 6 Blake Campbell Solar 0 0 0 16 Bloggs Plumbing 0 2 0 0 BLUEGUM ELECTRICAL SOLUTIONS PTY LTD 2 4 0 9 Boltz Contractors 1 0 0 2 Bravo Solar 0 2 1 2 Bridge Energy Solution 0 0 0 2 Brightex Solar 0 0 1 0 Bright Flow Plumbing 0 4 0 0 Brightworks Solar Pty Ltd 2 4 0 12 Bryn Pty Ltd T/A SolarGain 0 9 0 22 C2H Energy 0 1 0 0 Caltech Solar 0 0 0 5 CARBON SAVERS PTY LTD 0 223 0 0 Castleman Plumbing 0 1 0 0 CBR RENEWABLE ENERGY SOLUTIONS 0 2 0 5 CCL Energy 0 0 0 4 CDL ELECTRICALS 0 0 0 2 Central Spark Victoria 1 0 0 2 Cerium Energy 0 0 0 2 Certified Energy Group Pty Ltd 0 0 0 13 Champion Energy 0 0 0 6 Chase Renewables 0 0 0 2 Chief Electricians 1 0 0 7 Chin Electrical and Air Conditioning 0 0 0 1 Chris Conlan Electrical 0 7 0 1 Chromagen Australia 0 72 0 1 Chux Electrical 0 0 0 1 Clean Energy Solutions 0 0 0 3 Clean Technology Services Aus 0 0 0 19 Click Control Systems 0 0 0 4 CM Solar Solutions 0 0 0 2 Cobram Electrical & Data 0 0 0 5 Committed Solar Solutions 0 0 0 2 Connect Solar and Electrical Pt 1 0 0 4 Continental Power Solutions Pty Ltd 0 0 0 2 Cooper Plumbing Group 0 4 0 0 Cosmic Renewable Energy 0 1 0 4 Cosmic Solar 0 0 0 7 Craftec Electric 0 0 0 1 Crowlz Electrical Pty Ltd 0 0 0 1 Crystal Solar Energy 0 0 0 3 CSK Electrical N Solar 0 0 0 1 CS Solar 1 0 0 1 Cyanergy Pty Ltd 0 269 0 1 Darebin Heat Pumps 0 27 0 0 David Rosser Plumber and Gasfitter 0 2 0 0 Day's Electrical Contracting 0 0 0 1 Delight Solar Pty Ltd 0 0 0 8 De Santis Air and Electrical Pty Ltd 0 0 0 3 Devam Solar 0 2 0 1 Direct Building Solutions Australia 0 6 0 0 DIRECT NRG 0 0 0 1 Direct Solar Wholesaler Renewable Energy Group 0 0 0 3 Discover Solar 1 0 0 3 DMB Electrical 0 0 0 1 DNL Electrics 0 0 0 2 DODO SOLAR 0 3 0 20 Do Solar Pty Ltd 0 5 0 6 DS Bryan Pty Ltd 0 0 0 1 DT Electrical & Data Communications P/L 0 0 0 1 Dunton Group Electrical Services 3 0 0 1 Dynamic Renewables 0 0 0 1 Earthworker Energy Manufacturing Cooperative 0 5 0 0 East Gippsland Solar 1 0 0 0 East West Energy Pty Ltd 0 0 0 2 ECHO GROUP CORPORATION PTY LTD 1 0 0 14 Eco Alliance 0 102 0 0 Eco Assets Manager 0 15 0 0 Eco Choice Solar 0 7 0 10 ECO ENERGIZERS 1 1 0 1 Eco Future Group 1 1 0 2 Ecomad 0 1 0 0 ECOORIGIN 0 1 0 0 ECOSAVER AUSTRALIA PTY LTD 0 2 0 0 Eco Solar Australia 0 0 0 3 Eco Soul Australia 0 1 0 0 EcoSun Solar & Electrical 1 0 0 0 Efficient Pure Plumbing Heating & Cooling 0 4 0 0 Eiffel Energy 0 0 0 1 Elcon Solar Pty Ltd 2 0 0 1 Electrical Doctorz 0 0 0 1 Electrical Masters 1 0 0 33 Elect Solar 0 0 0 1 Elite Energy Group 0 0 0 1 Elite Smart Energy Solutions 0 59 0 0 Emerging Solar 0 0 0 2 Empower Solar Australia 1 1 0 3 Endeavour Solar 0 3 0 0 Energise 1 0 0 2 Energised Electrical & Air Conditioning 0 0 0 1 Energis Smart Energy Solutions 2 0 0 2 Energized Solutions 0 0 0 2 Energy Assist Group 2 0 0 7 Energy Benefits 0 7 0 4 Energy Cloud Australia 0 0 0 1 Energy Control Australia 0 0 0 4 Energy Efficient 0 0 0 1 Energy Goals 0 7 0 2 Energy Makeovers 0 8 0 0 EnergySaversAu 0 13 0 0 Energy Wired Pty Ltd 1 0 0 0 Envirogroup 0 9 1 7 EnviroShop 0 2 0 3 EOC Energy 0 1 0 1 Erg Energy 0 0 0 4 ER Solar 0 0 0 1 ESI Solutions Pty Ltd 0 0 0 1 Essential Solar 2 5 0 5 E-TEC PTY LTD 0 0 0 1 Eureka Solar & Battery 0 0 0 3 Evergreen Solar Power 1 0 0 16 Everyday Energy 0 2 0 1 Everyday Solar Solutions 0 7 0 0 Evitech 0 19 0 0 Evo Solar 1 0 0 1 Excel Safe Electrical 0 0 0 3 Exegi Pty ltd 0 1 0 0 Expert Hot Water & Plumbing 0 4 0 0 Expert Plumbing and Gas Services 0 1 0 0 Fair Solar 0 0 0 2 Fair Value Solar 0 1 0 17 Fast Solar 0 0 0 1 Flow Power Solar Pty Ltd 0 0 0 1 Formosa Electrics 0 1 0 1 Fortune Solar 1 0 0 13 Foster Hydronic Heating 0 2 0 0 Future Friendly Solar Power 0 0 0 3 Future NRG 2 11 0 19 G and H Electrics 1 0 0 1 Gary Schmidt Electrical 0 0 0 2 Gaschill 0 9 0 0 Gecko Solar Energy 0 1 0 2 Geelong Heat Pumps 0 16 0 0 Geelong Solar Energy 0 0 0 15 Ghan Electrics 1 0 0 1 GI Energy 1 0 0 1 GigaWatt Energy 0 0 0 1 Glen Clark & Co 0 0 0 1 Glower 0 57 0 2 GN&ZEF ELECTRICAL PTY LTD 0 0 0 1 Gnowee Solar 2 0 0 4 Goal Solar 0 0 0 5 Go Get Electric 0 4 0 0 Go Green Aus Pty Ltd 0 5 0 3 Going Solar 0 0 0 1 Goodbye Gas 0 5 0 0 GP Solar 0 2 0 4 Green.com.au 14 1 0 11 Green City Electrical 0 0 0 1 Green Earth Electrical 0 0 0 1 Green Edge Technologies 0 4 0 4 Green Electric Solutions 1 7 1 33 Green Energy Needs 0 2 0 1 GREEN ENERGY POWER CO 0 20 0 0 GREEN ENERGY SAVERS PTY LTD 0 23 0 0 Greener Upgrade 0 0 0 2 Green Home Green Planet 0 57 0 0 Greenify Energy 0 13 0 0 Green Line Solar 1 0 1 7 Green Machine Solar & Electrical Pty Ltd 0 0 0 1 Green On Pty Ltd 0 4 0 0 GREENOZ SOLUTIONS 0 2 0 1 GreenPlumb 0 1 0 0 Green Power Gen 0 0 0 2 Greensaver Solar 0 0 0 2 Green Savings 0 5 0 6 Green Sky Solar 2 0 0 5 Green Solutions Australia Pty Ltd 0 3 0 0 Green Source 0 11 0 0 GREENTASTIC PTY LTD 0 5 0 0 Greentech Engineering Solutions 1 0 0 14 Green Upgrades 0 1 0 0 Green User 0 11 0 0 Green Valley Solar 0 0 0 2 Green Vision Solar 4 6 0 27 GREEN WAVE ELECTRICAL SERVICES 0 0 0 1 GRIAN SOLAR POWER 0 0 0 9 Grow Energy Trust 0 4 0 1 Hampson Electrical Services PTY LTD 0 0 0 2 Harley Plumbing 0 3 0 0 Harlow Electrical and Solar 1 0 0 1 HAS ENERGY PTY LTD 0 0 0 23 Hayespower Electrics 1 0 0 3 Hazard Electrical Victoria Pty Ltd 0 0 0 1 HDC Electrical Pty Ltd 0 0 0 4 Heat Pump Pros 0 1 0 0 Helcro Solar 0 4 0 14 Helios Solaire 0 0 0 6 Hello Solar 1 5 0 9 Hills Energy Solutions 0 0 0 1 Hinch Plumbing 0 1 0 0 Hi-Power Electrical Pty Ltd 0 0 0 1 Hisolar Energy Pty Ltd 0 0 0 2 Hi Tech Hot Water 0 14 0 0 Hot and Cold Shop/Solahart 0 5 0 5 Hot Water Professionals 0 5 0 0 HP Energy 1 7 0 15 HQ Solar & Electrical 0 0 0 1 HT Electrics Pty Ltd 0 0 0 3 Hybrid Solar Solutions Australia 2 0 0 19 Hydronic Heating Eltham 0 1 0 0 Hytech Solar Batteries 2 0 0 12 IBISS Electrical 0 0 0 1 Iconic Solar 0 0 0 2 Ilios Energy 0 5 0 0 Illumina Energy 0 0 0 1 Immerge Group 0 1 0 0 Incredible Solar and Energy Solutions 0 1 0 2 INDO WEST ELECTRICAL 0 0 0 2 Infinity Solar Solutions 0 0 0 9 Inspire Solar 0 1 0 10 Instyle Solar 0 0 0 13 Intelligent Solar & Energy Solutions Pty Ltd 1 3 0 5 Intellihub 1 0 0 1 Invincible Energy 3 2 0 79 IONIC ELECTRIC 0 0 0 1 IPromise 0 2 0 0 Irvine Electrical and Data Solutions 0 0 0 1 Island Energy 2 2 0 13 Iwire Electrical & Solar Pty Ltd 0 0 0 1 Jarrod Arentz Electrical Pty Ltd 0 0 0 1 Java Energy Solutions 0 0 0 14 Jaycee Plumbing and Gas Fitting 0 11 0 0 JBE Solar and Electrical 0 0 0 1 JCS INDUSTRIES PTY LTD 1 1 0 0 JE Group 0 0 0 13 Jet Solar 6 1 0 17 Jeztek Plumbing 0 4 0 0 Jim's Energy (Carnegie) 0 0 0 2 Jim's Energy (Melbourne and Regional) 4 6 1 25 Jim's Energy (Mornington) 0 0 0 8 Jim's Energy (South Morang) 0 0 0 4 Jim's Energy (Sunshine North) 1 1 1 2 Jim's Energy Burnside Heights 0 2 0 9 Jims Energy Caulfield South 0 8 0 5 Jims Energy Taylors Lakes 1 1 0 6 JM Solar Solutions 0 2 0 11 JR Evans Heating and Cooling 0 1 0 0 JSA SOLAR 0 0 0 1 Just Energy 0 0 0 1 JUST GREEN AUSTRALIA PTY LTD 0 8 0 0 JWS Electrical Services 0 0 0 13 K.A.W Electrical & Solar 1 0 0 0 KDEC Electrical & Solar 2 0 0 6 Kenny Solar 0 0 0 4 KESelec Electrical Services 0 0 0 1 KIK Electrics 2 0 0 3 Kingsolar Pty Ltd 0 0 0 1 Krypton Group 0 4 0 1 Lakes Solar 0 5 0 10 Lamb & Anderson Electrical 0 1 0 0 Laser Electrical Horsham 0 0 0 1 LDB Heating & Cooling 0 1 0 0 Lead Pool Pty Ltd 0 1 0 1 LEDCOM 0 51 0 0 Liberty Electrical and Air Conditioning 0 1 0 0 Life Solar Pty Ltd 0 0 0 2 Lighting & Energy Conservation Australia 0 5 0 10 Lightning Energy 0 11 0 11 Lindustries Electrical Contracting 1 0 0 2 Linked Solar 1 0 0 6 Living Solar 0 1 0 0 Local Energy Group 1 0 0 3 LPS Electrical Services Pty Ltd 1 1 0 3 LUMENX 0 0 0 1 LV Electrical & Maintenance 0 0 0 1 Magma Electrical 1 3 0 6 Mahoney & Da Silva PTY LTD 0 0 1 0 Make My Energy 0 0 0 1 Manifold Plumbing 0 1 0 0 Mansfield Pump Shop and Electrical 0 1 0 0 Maroondah Air Group 0 2 0 0 Marshall Energy Solutions 0 0 1 10 Matthew Walsh Electrical Pty Ltd 0 0 0 1 Maxim Energy 0 0 0 3 Max Power Electrical 0 2 0 2 Maxwell Energy 0 0 0 1 MD Electrical & Air Conditioning Pty Ltd 0 0 0 1 Melbourne Heat Pumps 0 23 0 0 Melbourne Hot Water 0 1 0 0 Mercy Rays 0 0 1 0 Metro Solar NSW Pty Ltd 1 10 0 5 MFR Plumbing Co 0 1 0 0 MGR Pumbing 0 1 0 0 Midland Solar 0 1 0 11 Mildura Solar 0 0 0 4 M Lia Electrics 0 0 0 1 Motek Electrical 0 0 0 2 MSA Electrical Services Pty Ltd 1 0 0 1 Mululu Plumbing 0 1 0 0 Murcott Electrical Pty Ltd 0 0 0 2 Murray River Electrical 1 0 0 1 MY XPERT PLUMBERS 0 2 0 0 N.G Cabling Solutions 0 0 0 1 National Grid Support Services 0 0 0 12 Natural Solar 2 0 0 1 Nelson Electrics Pty Ltd 0 0 0 2 NewGen Solar & Heat Pumps 0 9 0 0 New Sky Energy Solutions 0 0 1 1 New Tech Energy 0 0 0 1 Newvolt Energy Pty Ltd 0 0 0 3 Nexgen Power Solutions 0 0 0 2 Next Generation Energy 0 0 0 2 NHC Solar 0 5 0 5 No1 Solar 0 0 1 6 Noor Solar & Electronics 0 0 0 2 Northern Sparkies 0 0 0 2 NXT GEN SOLAR PTY LTD 0 0 0 2 O'Brien Electrical and Plumbing Rowville 7 85 1 43 O'Brien Electrical Warrnambool 0 8 0 2 O'Brien Plumbing Echuca Moama 0 1 0 0 O'Briens Plumbing and Air Conditioning P/L 0 2 0 0 Oasis Airconditioning & Solar 0 2 0 1 Off-Grid Energy Australia 0 0 0 1 Off The Grid Group 0 0 0 5 Olver Electrical 0 0 0 1 Omni Electrical 0 2 0 2 One Stop Utilities 0 0 0 4 Online Air and Solar 4 6 0 16 Opt Energy 0 4 0 0 Optimised Electrics Pty Ltd 0 0 0 1 Origin Energy Electricity Limited 0 0 0 2 OZ Power Saver 0 1 0 0 Oz Solar Energy Solutions Pty Ltd 1 0 0 7 Paarlberg, Dylan John 1 0 0 1 Paragon Solar Power Pty Ltd 1 0 0 4 Passivetech 0 1 0 0 PATEL ELECTRICAL PTY LTD 0 0 0 6 PBR Solar 0 0 0 9 Peak Energy Group 2 5 2 4 Peninsula Heat pumps 0 3 0 0 Peninsula Precision Solar 0 0 0 1 Platinum Plumbing Plus 0 1 0 0 Plico Energy 2 0 0 2 PLUMB2BUILD PTY LTD 0 1 0 0 Plumb on Plumbing 0 3 0 0 Plum Electrical Pty Ltd 2 0 1 0 Plum Heating & Cooling Pty Ltd 0 7 0 0 Positive Carbon 0 19 0 0 POWERBAND ELECTRICAL PTY LTD 0 3 0 0 Power Co Electric Solutions Pty Ltd 0 0 0 1 Power Providers 0 0 0 2 Powrhouse 0 11 0 0 Prentice Electrical 0 1 0 0 Primero Electric & Solar 0 0 0 6 Pristine Solar 0 0 0 1 Proex Electric 0 3 0 5 Prolific Electrical Pty Ltd 0 0 0 1 Prosolar Global 1 0 0 6 Pro Solar Solutions 0 0 0 1 Protec Electrical & Solar 0 0 0 1 Puma Solar 0 3 0 23 Pure Electric Solutions 0 5 0 1 Purtle Electrical 0 0 0 1 R&J Monty's Electrical 0 0 0 1 RACV Solar 8 0 2 58 Radius Technology 0 0 0 1 Ragg Volt 0 0 0 1 Raldex Plumbing 0 1 0 0 Ramselec Solar 0 0 0 12 Raso Electrical 0 0 0 1 Ray Watt Electrical and Solar 0 0 0 1 RB Electrical & Solar 0 0 0 3 RDC Plumbing T/A Surfside Plumbing 0 1 0 0 Real Response Electrical 0 0 0 4 Redefining Solar 0 0 0 6 Red Solar 0 0 0 6 Refrigelec 0 0 0 1 Renewable Energy Pty Ltd 0 4 0 0 Renewable Energy Upgrades 0 3 0 1 Renewable Solar 1 0 0 0 Revive Enviro HP 0 36 0 0 RevoluSun Power 0 0 0 8 Revolutionary Solar 0 0 0 2 Rockys Solar 1 0 1 9 Rooftop Solar 0 0 0 10 RTB Electric 0 1 0 2 Ruff Renewable Energy 0 2 0 1 Russell's Heating Cooling & Hot Water 0 3 0 0 RVB Energy 1 2 0 11 S.J Plumbing Central Victoria 0 4 0 0 Safe Planet Pty Ltd 0 15 0 0 Sahara Solar Australia 0 0 1 0 SAILAX GLOBAL TECHNOLOGIES PTY LTD 0 0 0 4 Sales Expert 0 2 0 5 SALINGER ELECTRICAL PTY LTD 0 1 0 0 Same Day Hot Water Service 0 16 0 0 Samsung Energy 1 0 0 8 San Solar and Batteries 0 0 0 1 Sapphire Solar 1 0 0 3 Satellite Solar Pty Ltd 0 0 0 2 Saving Earth Pty Ltd 0 50 0 8 SAVVY SOLAR 0 0 0 3 SBS Solar & Electricals 0 0 0 1 Schumacher Solar & Electrical 0 0 0 3 Sea Energy Group 0 0 0 5 Seam Electrical Solar and Battery 1 0 0 0 Seek Solar 0 2 0 9 Seidel Electrical 0 0 0 1 SEN Australia 0 0 0 5 SGM Plumbing 0 1 0 0 SGT Plumbing 0 2 0 0 Shark Solar 2 0 2 10 Shining Solar 1 0 0 10 SILICON SOLAR 0 0 0 31 Simply Solar Energy 0 0 0 11 Six Star Plus 0 0 0 8 SKY ENERGY 1 0 0 1 Sleeth Electrical Pty Ltd 0 1 0 2 Smart Energy Answers 3 0 0 6 Smart Energy Upgrades 0 4 0 0 Smarter Home Solutions Pty Ltd 1 7 0 1 Smart Savy Solutions Pty Ltd 0 0 0 2 Smart Upgrades 0 2 0 0 Smart User 0 8 0 10 Smart Wise Solar 0 0 0 7 Smith and Freshwater Electrical 0 0 0 1 Solahart Ballarat 0 2 0 2 Solahart Bendigo 0 1 1 1 Solahart Eastern Ranges 0 10 0 10 Solahart Geelong 0 2 0 1 Solahart Greater Gippsland 0 6 0 4 Solahart Melbourne 0 7 0 4 Solahart WAW Pty Ltd 0 4 0 2 Sola Now Pty Ltd T/A Sunterra 3 0 0 4 Solar 1 Electrical 0 1 0 12 Solar 360 Australia T/A Solargain South East Victoria 0 11 0 12 Solaraide 0 0 0 2 Solar Avenue 0 2 0 4 Solar Battery Group 2 3 0 2 Solar Battery Power Specialists 1 0 0 1 Solar Boom 0 0 0 1 Solar Boss 0 0 0 15 Solar Brightness 0 0 0 8 Solar Dynamics 3 1 0 4 Solar Emporium 3 0 0 62 Solar Energy Partners 4 0 1 6 Solar Ezway 0 0 0 1 SolarFeed 0 0 0 5 Solar Five 0 0 0 1 Solar Flow 0 3 0 4 Solargain Echuca 1 0 0 7 Solargain Gippsland 1 5 0 7 Solargain PV Pty Ltd 3 8 0 9 Solargain Warrnambool 0 1 0 1 Solar Harbour 0 0 0 1 Solarhub Melbourne 3 0 0 5 Solar Integrity 0 1 0 5 Solar Link Australia P/L 4 0 1 12 Solar Masters 3 0 0 35 Solar Mentor 0 0 0 1 Solar Merchants 0 0 0 3 Solar Miner 4 0 1 30 Solar Nation 0 0 0 1 Solar On Electrical 0 0 0 1 Solar On Panels 0 0 0 3 SOLARPLUS ENERGY 1 0 0 6 Solar Power Outlet 0 0 0 4 Solar Pro Bendigo 2 3 0 10 Solar Revolution 0 0 0 5 Solar Run 0 0 0 1 Solar Run Ballarat 0 0 0 3 Solar Run Beaconsfield 0 0 0 2 Solar Run Bendigo 0 2 0 2 Solar Run Bentleigh 0 0 0 1 Solar Run Berwick 0 1 0 0 Solar Run Keysborough 1 4 0 10 Solar Run Kilmore 0 0 0 7 Solar Run Langwarrin 1 1 0 3 Solar Run Lara 0 11 0 14 Solar Run Mount Eliza 0 0 0 2 Solar Run Ringwood 1 0 0 1 Solar Run Sunshine 0 1 0 0 Solar Run Traralgon 0 1 1 0 Solar Run Warrnambool 0 0 0 4 Solar Run Whittlesea 1 0 0 2 Solar Run Wyndham Vale 0 0 0 3 Solar Secure 0 0 0 16 SolarSeed 0 0 0 15 Solar Service Guys 0 0 0 2 Solar Smart Australia 0 0 0 3 Solar Spirit 1 1 0 25 SOLAR SUNFILL 0 0 0 1 Solar Today 0 0 0 4 Solarvista 0 0 0 5 Solarwise Group 0 0 0 1 Solazone Victoria Pty Ltd 0 0 0 1 Solbase 0 0 0 1 Sol Excel Pty Ltd 1 0 0 2 Solstra 0 2 0 4 Soltech Solar 1 5 0 3 Solutions4Solar 0 0 0 2 Solution Solar 1 0 0 6 SOLUTION WITH SAM 0 0 0 1 South Beach Solar 0 0 0 1 Southeast Solar Australia 0 0 0 4 Sparkin Energy Australia 0 0 0 1 Sparky4Hire 0 1 0 0 Spec Air Solar & Batteries 0 0 0 1 SPECIALIZED Solar & Electrical 3 8 0 9 Spot on A/C & Electrical 0 0 0 4 SP Solar 0 0 0 1 Stanalec Pty Ltd 1 1 0 3 Start Solar 0 3 0 13 Steve Thomas Plumbing & Maintenance 0 1 0 0 Stewart Air Conditioning and Plumbing 0 1 0 0 Sun 2 Solar 0 2 0 8 Sunbeat Solar 0 0 0 1 Sunburn Solar 1 8 0 3 Sun Central Solar 0 0 0 3 SUN COMMERCE 0 0 0 2 SUN CURRENT 2 4 0 30 SunDirect Energy 0 1 0 2 Sundrop Solar 0 0 0 2 Sunergy Solar 1 2 0 9 Sun Group Energy 0 0 0 18 SUNLINE ENERGY 4 9 0 3 Sunnier Solar 0 0 0 1 Sunny Solar 0 1 0 6 Sunpark Solar 0 0 0 3 Sun Phase Electrical 0 0 0 1 SunPlan Energy 0 0 0 2 Sun Power Electrics 0 0 0 1 Sunrays Power 0 0 0 2 Sunrise Innovations 0 17 1 68 Sunrise Saves Energy Pty Ltd 0 1 0 0 Sunrun Solar Pty Ltd 2 0 0 5 Sunsational Solar 0 0 0 2 Sunsmart Solar Energy 0 0 0 3 SunSolar Energy Pty Ltd 2 1 0 50 Sunstainable Pty Ltd 0 0 0 1 Sunworks Eco Plumbing 0 1 0 0 Sunworx Energy 0 0 0 3 Supa Solar 0 0 0 4 Supply Solar 0 0 0 2 Suri & Suri Electrical Pty Ltd 0 0 0 2 SUSTAINABLE ENERGY AUSTRALIA PTY LTD 0 1 0 0 Sustainable Energy Solutions World 0 0 0 5 Sustainable Facility Group Pty Ltd 0 2 0 0 Sustainable Plumbing Solutions Pty Ltd 0 4 0 0 Sustainable Solar Services PTY LTD 0 0 0 1 Switch 2 Solar 0 0 0 3 t2zero 0 1 0 0 Target Green 0 4 0 1 Target Solar 0 0 0 3 TCK Solar 0 3 0 7 Technaus Solar 1 0 0 8 Tempo 0 0 0 19 The Green Guys Group 0 2 0 0 The Happy Plumber 0 2 0 0 The Heat Shop - Geelong 0 2 0 0 The Hot Water Man 0 1 0 0 Thermochill Plumbing and Electrical 0 1 0 0 The Solar People 0 0 0 1 Think and Grow Renewable 0 3 0 4 Think Solar 0 2 0 3 Thompson Electrical Solar 1 0 0 1 Thompson Electrical Solutions 0 0 0 2 Tim Aumann Plumbing 0 1 0 0 Time 4 Solar 0 70 0 1 TIMETOSAVE PTY LTD 0 15 0 0 TINDO OPERATIONS CO PTY LTD 0 0 0 1 TJM Electrical Services 1 0 0 7 Too Hot to Handle Heating & Cooling 0 12 0 0 Total Solar and Electrical 0 0 0 1 Total Solar Solutions Australia 1 4 0 7 TP Solar 0 0 0 1 Trademark Energy Pty Ltd 0 0 0 2 Traeger Solar 1 0 0 5 TR Electrical & Solar 0 0 0 1 Trentham Electrical and Solar 0 1 0 4 Tri CT Elec PTY LTD 0 1 0 2 TRIONE ENERGY (AUS) PTY LTD 0 0 0 12 Twin City Electrical & Solar 1 0 0 3 Ultima Energy 0 0 0 5 Ultimate Solar Energy/ RA connect pty ltd 1 2 0 2 Ultinity Power Solutions 0 0 0 2 Uncommon Solar 2 0 0 2 Unified Energy Services 4 0 1 25 Unique Solar Solutions 0 0 0 4 United Energy Group 0 0 0 1 Urban Electrical Services Pty Ltd 1 0 0 3 VALCOMM ELECTRICAL 0 0 0 1 Variety Solar 0 2 0 5 Veeken Plumbing Services Pty Ltd 0 3 0 0 Velocity Solar 1 0 0 5 Venergy Australia 5 1 0 15 Vertex Solar Energy 0 0 0 1 Vic Energy Solutions 0 3 0 0 Vic Power & Data 0 0 0 1 Vicsaver 0 3 0 0 Vision Environmental Solutions 0 1 0 0 VJ Energy Group 0 0 0 2 Volt Solar Australia 0 32 0 0 Vortex Electrical 0 2 0 2 V Power Solar 0 0 0 3 VV Electrical and Solar 0 0 0 2 Wades Horsham 1 7 0 5 Wade Smith Plumbing 0 2 0 0 Waldron Heating Cooling & Hot Water 0 8 0 0 Waldron Solar Solutions 0 0 0 6 Walsh Electrical Refridgeration & Air Conditioning 0 0 1 0 Wangaratta Solar 0 0 0 1 Want a Heat Pump 0 15 0 0 Warrnambool Solar 0 0 0 2 Watters Electrical Pty Ltd 1 9 0 9 Western District Electrical Services 0 0 0 1 Western Elec 1 0 0 2 Winki Solar 0 3 0 10 WM Solar & Electrical 0 0 0 2 Yarra Solar 0 0 0 2 YOURGREENENERGY 0 0 0 2 ZECO Energy 5 3 0 14 Zed Energy 0 0 0 3 Zero Energy Australia 0 0 0 3 Zing Solar Vic 0 1 0 3 Zip Solar 0 0 0 7 Total 273 2692 31 3068 Retailer Battery (Owner Occupier) Hot Water (Owner Occupier) Solar PV (Landlord) Solar PV (Owner Occupier) 0CARBON 0 7 0 0 1KOMMA5 Sydney and Melbourne 1 0 0 1 1Power Solar 1 0 0 3 1 Solar Australia 0 0 0 3 360 Electrical Group 0 0 1 0 365 Solar Australia 0 0 0 7 3 Phase Solar Pty Ltd 0 0 0 1 3P Solar 5 0 3 115 4Shaw Plumbing 0 1 0 0 60 Shades 0 4 0 0 85 Energy Pty Ltd 0 0 0 1 A1 Solar & Electrical Gippsland 2 2 0 5 Abacus Solar 0 2 0 4 Accredited Power Saver 0 53 0 0 Active Energy Group 0 0 0 5 ADMB Group 0 0 0 1 Adopt Solar 0 0 0 15 ADSA Australian Solar 0 0 0 2 Adsolar & Electrical PTY LTD 1 0 0 2 ADS Solar 0 0 0 1 Advanced Energy Management 2 1 0 7 Advanced Solar & Batteries 1 0 0 5 Advanced Solartech 1 0 0 0 Advantage Solar 0 0 0 45 Agility Solar 0 0 0 4 AGL Solar 1 0 0 0 AGP Plumbing & Gas 0 1 0 0 All Electric Homes 1 2 0 2 Alliance Solar 0 0 1 1 ALLIANCE SUNPOWER 0 0 0 1 All Points Energy Solutions 0 1 0 1 Alphabet Energy 0 0 0 1 ALR Designs Pty Ltd 0 0 0 1 Amazing Solar Solutions 6 0 0 126 AME KURTA PTY. LTD. T/A Jims Energy 0 3 0 8 AMISOLD 0 1 0 0 Ampforce Solar Pty Ltd 0 0 0 3 ANB Plumbing 0 1 0 0 Apex Global Solutions 0 0 0 1 Arkana Energy Group 8 0 0 20 ARKG Trading Pty Ltd 1 1 0 15 Aruonergy 0 3 0 2 Astra Solar Pty Ltd 0 0 0 1 Astronic Solar 0 0 0 3 Astute Technologies 0 0 0 1 Aurinko Energy 0 0 0 1 Ausceylon Solar 2 0 0 0 Ausielectricals Pty Ltd 0 0 0 1 Ausolec Solar 1 0 0 0 Auspro Group 0 5 0 0 Aussie Ecomarks 0 3 0 0 Aussie Greenmarks 0 14 0 0 Austech Electrical and Plumbing Services 0 28 0 6 Australian Climate Systems 0 2 0 0 Australian Design Solar Pty Ltd 0 0 2 15 Australian Eco Energy 0 0 0 3 Australian Energy Upgrades 0 15 0 0 Australian Green Solution 0 276 0 0 Australian Solar and Energy Solutions 0 0 0 3 AU SUN SOLAR 0 0 0 2 AUZBRIGHT 0 31 0 0 AVM Electrical 0 0 0 3 Axial Electric 0 2 0 1 AZ Solar 0 0 0 12 AZTEK WIND AND SOLAR PTY LTD 0 0 0 1 Bacchus Marsh Plumbing Service 0 2 0 0 BaileyTech Solar & Electrical 0 0 0 4 Ballarat Essential Plumbing 0 3 0 0 Ballarat Solar & Electrical 0 0 0 3 Ballarat Solar Company 0 1 0 3 Ballarat Solar Panels 0 0 0 2 Bascon Solar Solutions 0 0 0 1 Baxter Electrical T/A Swift Solar Repairs 0 0 0 2 BD Electrics 0 0 0 2 BD NORTH EAST ELECTRICS PTY LTD 0 0 0 3 Ben Davey Plumbing 0 1 0 0 Bespoke Solar 0 0 1 3 Beston Group (VIC) Pty Ltd 0 1 0 0 Betta Value Renewable Energy 0 0 0 9 Billabong Solar 0 0 0 4 BJ White Electrics 0 1 0 7 Blake Campbell Solar 0 0 0 6 Bloggs Plumbing 0 3 0 0 BLUEGUM ELECTRICAL SOLUTIONS PTY LTD 0 2 0 1 BNM Solar 0 0 0 3 Border Energy Solutions 1 0 0 0 Bravo Solar 0 0 0 5 Bridge Energy Solution 0 0 0 2 Brightex Solar 0 0 0 1 Bright Flow Plumbing 0 1 0 0 Bright Switch Solar 0 0 0 1 Brightworks Solar Pty Ltd 4 0 0 11 Bryn Pty Ltd T/A SolarGain 0 8 0 13 C2H Energy 0 3 0 0 Caltech Solar 0 0 0 6 CARBON SAVERS PTY LTD 0 198 0 0 Casone Electrical 0 1 0 0 Castleman Plumbing 0 2 0 0 CBR RENEWABLE ENERGY SOLUTIONS 0 1 0 0 CDL Electricals 0 0 0 1 Central Spark Victoria 1 0 0 7 Cerium Energy 0 0 1 2 Certified Energy Group Pty Ltd 0 0 0 6 Cetinich Electrical and Solar 1 0 0 0 Champion Energy 0 0 0 2 Chief Electricians 0 0 1 7 Chin Electrical and Air Conditioning 0 0 0 3 Chris Conlan Electrical 0 7 0 2 Chromagen Australia 0 53 0 2 Clean Energy 365 0 0 0 1 Clean Energy Solutions 1 0 0 3 Clean Technology Services Aus 0 0 0 12 Click Control Systems 0 0 0 2 Cobram Electrical & Data 0 0 0 2 Committed Solar Solutions 0 0 0 1 Continental Power Solutions Pty Ltd 0 0 0 3 Coreworx Solar and Electrical 0 0 0 1 Cosmic Renewable Energy 0 0 0 2 Cosmic Solar 0 0 0 2 CREATION X ENERGY 0 2 0 0 Cyanergy Pty Ltd 0 235 0 0 Darebin Heat Pumps 0 19 0 0 Darkhorse Electrical 0 0 0 1 David Rosser Plumber and Gasfitter 0 3 0 0 Davpro Plumbing & Gasfitting Service 0 1 0 0 Delight Solar Pty Ltd 0 0 0 3 Devam Solar 1 2 0 3 Digitec Australia 0 0 0 1 Direct Building Solutions Australia 0 1 0 0 DIRECT NRG 0 0 0 1 Direct Solar Wholesaler Renewable Energy Group 0 0 0 6 Discover Solar 1 1 0 5 DNL Electrics 0 1 0 1 DODO SOLAR 0 0 0 9 Do Solar Pty Ltd 2 2 0 2 DOUBLE H LINK PTY LTD 0 0 0 1 DT Electrical & Data Communications P/L 0 0 0 1 Dunton Group Electrical Services 0 0 0 3 Earthworker Energy Manufacturing Cooperative 0 5 0 0 East Gippsland Solar 0 1 0 0 ECHO GROUP CORPORATION PTY LTD 1 0 0 8 Eco Alliance 0 71 0 0 Eco Assets Manager 0 13 0 0 Eco Choice Solar 0 3 0 2 ECO ENERGIZERS 0 3 0 1 Eco Future Group 0 0 0 1 Ecomad 0 1 0 0 ECOSAVER AUSTRALIA PTY LTD 0 1 0 0 Eco Solar Australia 0 0 0 1 EcoSun Solar & Electrical 0 0 0 5 Efficient Pure Plumbing Heating & Cooling 0 4 0 0 Eiffel Energy 0 1 0 0 Elcon Solar Pty Ltd 2 0 0 4 ELECTRA ENERGY 0 1 0 0 Electrical Doctorz 0 0 0 3 Electrical Masters 1 1 0 24 Elect Solar 0 1 0 2 Elite Renewables 0 0 0 2 Elite Smart Energy Solutions 0 60 0 0 Elite Solar Pro 0 0 0 1 Elite Vin Solar 0 0 0 2 Emerging Solar 0 0 0 5 EMI Australia 0 0 0 1 Empower Solar Australia 0 0 0 2 Endeavour Solar 0 2 0 1 Energise 1 0 0 1 Energis Smart Energy Solutions 2 0 0 0 Energized Solutions 0 0 0 1 Energy Assist Group 1 0 0 5 Energy Benefits 0 3 0 2 Energy Cloud Australia 0 0 0 2 Energy Control Australia 0 0 0 4 Energy Goals 0 15 0 6 Energy Makeovers 0 12 0 0 EnergySaversAu 0 18 0 0 Energy Wired Pty Ltd 0 0 0 1 Envirogroup 0 5 0 5 EnviroShop 0 1 0 3 EOC Energy 0 0 0 2 Erg Energy 0 0 0 4 ESB and Services 1 0 0 0 ESI Solutions Pty Ltd 0 0 0 1 Essential Solar 2 4 0 18 Eureka Solar & Battery 0 0 0 3 Everest Electrical 0 0 0 1 Everglow Electrical, Solar and Batteries Pty Ltd 1 0 0 0 Evergreen Solar Power 0 0 2 18 Everlite Electrical 0 0 0 1 Everyday Energy 1 1 0 4 Everyday Solar Solutions 0 14 0 0 Evitech 0 18 0 0 Evo Solar 1 0 0 1 Excel Safe Electrical 0 0 0 1 Expert Plumbing and Gas Services 0 1 0 0 Ezy Energy 0 0 0 1 Fair Solar 0 0 0 1 Fair Value Solar 0 0 1 17 Fast Solar 0 0 0 1 Flood Solar 0 0 0 1 Formosa Electrics 0 1 0 1 Fortune Solar 0 0 2 14 Future Friendly Solar Power 0 0 0 2 Future NRG 1 9 1 12 G and H Electrics 1 0 0 0 Gary Schmidt Electrical 0 0 0 1 Gaschill 0 15 0 0 Gecko Solar Energy 0 0 0 1 GEE Energy 1 0 0 0 Geelong Heat Pumps 0 16 0 0 Geelong Solar Energy 0 0 0 18 GetSolar Pty Ltd 0 0 0 7 Ghan Electrics 0 0 0 2 GI Energy 0 0 0 1 GigaWatt Energy 0 0 0 2 Global Greens Aus 0 0 0 1 Glower 0 66 0 0 Gnowee Solar 1 0 0 3 Goal Solar 0 0 0 12 Go Get Electric 0 6 0 0 Go Green Aus Pty Ltd 0 4 0 2 Going Solar 0 0 0 1 Goodbye Gas 0 2 0 0 GP Solar 0 0 1 8 Green.com.au 4 1 0 14 Green Earth Electrical 0 0 0 3 Green Edge Technologies 0 1 0 1 Green Electric Solutions 1 16 0 34 Green Energy Needs 0 2 0 0 GREEN ENERGY POWER CO 0 15 0 2 GREEN ENERGY SAVERS PTY LTD 0 35 0 0 GreenGEN Solar 0 0 0 4 Green Home Green Planet 0 82 0 1 Greenify Energy 0 11 0 0 Green Line Solar 1 0 0 6 Greenmax Power Pty Ltd 0 0 0 1 Green On Pty Ltd 0 7 0 0 GREENOZ SOLUTIONS 0 1 2 0 Green Power Gen 0 0 0 1 Green Power Saver Australia 0 3 0 0 Green Savings 0 3 0 10 Green Sky Solar 0 0 0 6 Green Solutions Australia Pty Ltd 0 3 0 0 Green Source 0 1 0 0 GREENTASTIC PTY LTD 0 5 0 0 Greentech Engineering Solutions 0 0 0 14 Green Upgrades 0 6 0 0 Green User 0 6 0 0 Green Valley Solar 0 0 0 3 Green Vision Solar 4 1 1 11 GRIAN SOLAR POWER 0 0 0 12 Grow Energy Trust 0 8 0 0 Harley Plumbing 0 2 0 0 HAS ENERGY PTY LTD 0 0 1 16 Hazard Electrical Victoria Pty Ltd 0 0 0 1 HDC Electrical Pty Ltd 1 0 0 6 Heat Pump Pros 0 2 0 0 Helcro Solar 3 2 0 5 Helios Solaire 0 0 0 1 Hello Solar 0 1 0 12 Hills Energy Solutions 0 6 0 1 Hi Tech Hot Water 0 9 0 0 Horizon Solar Power 0 0 0 1 Hot and Cold Shop/Solahart 0 3 0 2 Hot Water Professionals 0 10 0 0 HP Energy 2 4 1 14 Hume Solar 0 0 0 1 Hybrid Solar Solutions Australia 1 0 0 19 Hytech Solar Batteries 0 0 0 8 Immerge Group 0 1 0 0 Incredible Solar and Energy Solutions 0 0 0 2 Infinity Solar Solutions 0 0 0 1 Ingram Group 0 0 0 1 Innovative Electrical Contractors 0 0 0 1 Inspired Green 0 2 0 0 Inspire Solar 0 0 0 3 Instyle Solar 1 0 0 14 Integra Energy Group 1 0 0 0 Intelligent Solar & Energy Solutions Pty Ltd 0 2 0 11 Intellihub 1 0 0 0 Invincible Energy 5 0 2 64 IPromise 0 2 0 0 Irvine Electrical and Data Solutions 0 0 0 1 Island Energy 1 2 0 11 I Solar Nation 0 2 0 1 Ivyndi Energy 0 0 0 2 Java Energy Solutions 0 0 0 4 Jaycee Plumbing and Gas Fitting 0 10 0 0 JBE Solar and Electrical 1 0 0 0 JCS INDUSTRIES PTY LTD 0 0 0 3 JE Group 0 0 0 15 Jet Solar 2 4 0 6 Jeztek Plumbing 0 9 0 0 JHB Electrical & Solar 0 0 1 0 Jim's Energy (Carnegie) 2 1 0 6 Jim's Energy (Melbourne and Regional) 1 1 1 12 Jim's Energy (Mornington) 0 0 0 18 Jim's Energy (South Morang) 0 0 0 8 Jim's Energy (Sunshine North) 1 1 0 8 Jim's Energy Burnside Heights 0 8 0 12 Jims Energy Caulfield South 1 5 1 5 Jims Energy Taylors Lakes 0 0 1 2 JMC Electrics Pty Ltd 1 0 0 0 JM Solar Solutions 1 1 0 5 Johnoelec Pty Ltd 0 0 0 1 Johnstone Electrical and Sunvalley Solar 0 0 0 1 JONES PLUMBING AND ELECTRICAL 0 1 0 0 JR Evans Heating and Cooling 0 2 0 0 JSA SOLAR 0 0 0 3 Just Energy 0 0 0 1 JUST GREEN AUSTRALIA PTY LTD 0 3 0 0 JWS Electrical Services 0 0 0 5 K.A.W Electrical & Solar 0 0 0 2 Kahkoli Australia Pty Ltd 0 1 0 0 KDEC Electrical & Solar 2 0 0 7 KENECT PTY LTD 0 0 0 1 Kennedy Electrical & Solar 0 0 0 2 Kenny Solar 0 0 0 2 KESelec Electrical Services 0 0 0 1 KIK Electrics 0 0 0 4 Kingsolar Pty Ltd 0 0 0 1 KJ Multi Maintenance 0 3 0 0 Klean Energy Solar 0 0 0 2 KOOLEC 0 0 0 2 Krypton Group 0 2 0 1 Kubo Electrical 0 0 0 1 Kushtech Power Solutions 0 0 0 1 Lakes Solar 0 3 0 1 Laser Electrical Horsham 0 0 0 2 Latrobe Plumbing 0 2 0 0 LDB Heating & Cooling 0 1 0 0 Lead Pool Pty Ltd 0 1 0 2 LEDCOM 0 35 0 0 Liberty Electrical and Air Conditioning 0 2 0 0 Lighting & Energy Conservation Australia 1 1 0 15 Limitless Energy 0 0 0 1 Lindustries Electrical Contracting 0 0 0 1 Linked Solar 0 1 0 7 Livesay Electrical 0 0 0 1 Local Energy Group 0 0 0 4 Long's Echuca Moama 0 1 0 2 LPS Electrical Services Pty Ltd 0 2 1 4 Lucklink 0 0 0 2 Luke Mitchell Electrical 1 0 0 0 LUMENX 0 1 0 2 Luminous Energy Solutions Pty Ltd 0 1 0 2 LV Electrical & Maintenance 0 0 0 1 Magma Electrical 0 1 0 6 Mahoney & Da Silva PTY LTD 0 1 0 1 Make My Energy 0 0 0 4 Maroondah Air Group 0 3 0 0 Marshall Energy Solutions 0 0 3 35 Martin Plumbing Group 0 2 0 0 Maxim Energy 0 0 0 1 Max Power Electrical 0 1 0 0 Maxwell Energy 0 0 0 2 MBC Power Solutions PTY LTD 1 0 0 0 MCCAIG AIR CONDITIONING 0 2 0 0 Melbourne Heat Pumps 0 26 0 0 Metro Solar NSW Pty Ltd 1 3 0 2 Midland Solar 1 1 1 7 Mildura Solar 0 0 0 3 Mitchell Shire Electrical 0 0 0 1 M L Roberts Electrical Pty Ltd 0 0 0 1 MSA Electrical Services Pty Ltd 0 0 0 1 Murray River Electrical 0 0 0 3 MY XPERT PLUMBERS 0 2 0 0 National Grid Support Services 0 0 0 10 Natural Solar 1 0 0 1 New Design Electrical 1 0 0 0 Newflo Plumbing 0 1 0 0 NewGen Solar & Heat Pumps 0 12 0 0 New Gisborne Electrical & Air Conditioning Services 2 0 0 1 New Sky Energy Solutions 0 0 0 2 Next Generation Energy 0 0 0 3 NHC Solar 0 3 0 1 No1 Solar 0 0 1 6 Noor Solar & Electronics 0 0 0 2 Northern Sparkies 0 0 0 6 O'Brien Electrical and Plumbing Rowville 5 58 0 48 O'Brien Electrical Warrnambool 0 7 0 2 O'Brien Plumbing Echuca Moama 0 1 0 0 O'Briens Plumbing and Air Conditioning P/L 0 2 0 0 Oasis Airconditioning & Solar 0 0 0 2 Oataway Heating & Cooling 0 3 0 0 Ocean Flow Plumbing 0 1 0 0 Off-Grid Energy Australia 0 0 0 1 Off Grid Plumbing 0 2 0 0 Olver Electrical 0 0 0 4 Omni Electrical 0 0 0 1 One Stop Utilities 0 0 0 1 Online Air and Solar 2 3 1 16 Opt Energy 0 4 0 0 Optimised Electrics Pty Ltd 0 0 0 2 Origin Energy Electricity Limited 0 0 0 5 OVO Electrical 1 0 0 20 Oz Solar Energy Solutions Pty Ltd 1 0 0 8 OZ SOLAR NEEDS 1 0 0 0 Ozwarm Home Services 0 1 0 0 Paragon Solar Power Pty Ltd 0 0 0 3 Passivetech 0 1 0 0 Pat Byrne Electrical 0 1 0 0 PATEL ELECTRICAL PTY LTD 0 0 0 4 PBR Solar 1 0 0 6 Peak Energy Group 2 3 0 8 Peninsula Heat pumps 0 6 0 0 Peter Carr Plumbing 0 1 0 0 Pipe Dream Plumbing and Drainage 0 2 0 0 Planet Green Australia 0 6 0 0 Plico Energy 1 0 0 0 PLUMB2BUILD PTY LTD 0 5 0 0 Plumbing By Hall Pty Ltd 0 2 0 0 Plumblife 0 1 0 0 Plum Electrical Pty Ltd 3 0 0 3 Plum Heating & Cooling Pty Ltd 0 2 0 0 Positive Carbon 0 36 0 0 POWERBAND ELECTRICAL PTY LTD 0 1 0 1 Powrhouse 0 10 0 0 Prentice Electrical 0 1 0 0 Primero Electric & Solar 3 0 0 6 Prosolar Global 0 0 0 5 Pro Solar Solutions 0 0 0 3 Prowater Plumbing 0 3 0 0 Puma Solar 0 0 0 9 Pure Electric Solutions 1 6 0 2 Purtle Electrical 0 0 0 2 RACV Solar 2 0 0 56 Ragg Volt 1 0 0 1 Rainbow Enterprises T/A Greenlink Solar 0 0 0 1 Ramselec Solar 0 0 1 4 Raso Electrical 0 0 0 1 RB Electrical & Solar 0 1 0 3 Real Response Electrical 1 0 1 4 Redefining Solar 1 0 0 1 Red Solar 0 0 0 3 Refrigelec 0 0 0 1 Regen Energy 0 0 0 1 Renewable Energy Pty Ltd 0 2 0 0 Renewable Energy Upgrades 0 11 0 0 Renewable Solar 1 2 0 2 Renowned Electrical & Airconditioning 0 0 0 1 Resinc Solar 0 0 0 1 Revive Enviro 0 43 0 0 RevoluSun Power 0 0 0 1 Right Choice Solar 0 0 0 2 Rockys Solar 0 0 0 3 Rooftop Solar 0 0 0 6 RTB Electric 0 1 0 1 Ruff Renewable Energy 0 1 0 3 Russell's Heating Cooling & Hot Water 0 3 0 0 S.E Energy Solutions 0 1 0 1 S.J Plumbing Central Victoria 0 1 0 0 Safelec Melbourne Pty Ltd 0 1 0 0 Safe Planet Pty Ltd 0 27 0 0 Sahara Solar Australia 0 0 0 1 SAILAX GLOBAL TECHNOLOGIES PTY LTD 3 0 0 8 Sales Expert 0 3 0 8 Same Day Hot Water Service 0 13 0 0 Samsung Energy 0 0 0 6 Sandhurst Solar 0 0 0 1 Sapphire Solar 3 0 0 2 Satellite Solar Pty Ltd 1 0 0 3 Save Energy Solution 0 2 0 0 Saving Earth Pty Ltd 0 32 0 6 SAVVY SOLAR 0 0 1 3 Seam Electrical Solar and Battery 0 0 0 1 Seek Solar 0 4 0 6 SEN Australia 0 0 0 2 SE SOLAR SOLUTIONS 0 0 0 1 Seymour Electrical and Solar 0 0 0 1 SGT Plumbing 0 1 0 0 Shark Solar 3 0 0 9 Shining Solar 0 0 0 2 SILICON SOLAR 0 0 0 18 Simply Solar Energy 0 0 0 7 Six Star Plus 0 0 0 8 SKY ENERGY 1 0 0 0 Sky Power Energy Pty Ltd 4 0 0 2 Smart Energy Answers 1 0 0 7 Smart Energy Upgrades 0 9 0 0 Smarter Home Solutions Pty Ltd 0 7 0 1 Smart Savy Solutions Pty Ltd 0 0 0 2 Smart Solar Energy 0 0 0 4 Smart Upgrades 0 3 0 0 Smart User 0 5 0 11 Smart Wise Solar 0 0 0 7 Smith and Freshwater Electrical 0 0 0 2 Solahart Ballarat 0 1 0 1 Solahart Bendigo 0 2 0 0 Solahart Eastern Ranges 0 7 0 5 Solahart Geelong 0 2 0 0 Solahart Greater Gippsland 0 4 0 4 Solahart Melbourne 0 4 0 3 Solahart WAW Pty Ltd 0 1 0 3 Sola Now Pty Ltd T/A Sunterra 5 0 0 11 Solar 1 Electrical 0 0 0 4 Solar 360 Australia T/A Solargain South East Victoria 0 4 0 13 Solar 370 Degrees 0 0 0 3 Solaraide 0 0 0 3 Solar Avenue 0 0 0 1 Solar Battery Group 0 1 0 4 Solar Beat 0 0 0 5 Solar Boom 0 0 1 2 Solar Boss 0 0 0 2 Solar Brightness 0 0 0 4 Solar Dynamics 1 1 0 5 Solar Emporium 7 0 0 48 Solar Energy Partners 2 0 0 2 SolarFeed 0 0 2 3 Solar Flow 0 4 0 5 Solargain Echuca 0 1 0 4 Solargain Gippsland 1 3 0 5 Solargain PV Pty Ltd 1 2 2 14 Solar Galaxy Pty Ltd 0 0 0 2 Solarhub Melbourne 2 0 0 11 Solar Integrity 1 2 0 6 Solar in Victoria 0 0 0 1 Solar Link Australia P/L 5 1 0 16 Solar Masters 1 0 0 41 Solar Merchants 0 0 0 2 Solar Miner 3 0 2 63 Solar Nation 0 0 0 2 Solar On Electrical 0 0 0 2 Solar On Panels 0 0 0 3 SOLARPLUS ENERGY 0 0 0 1 Solar Power Hub 0 0 0 2 Solar Power Outlet 0 0 1 5 Solar Pro Bendigo 2 5 0 7 Solar Revolution 0 0 0 3 Solar Roof 0 1 0 0 Solar Run Ballarat 1 0 0 4 Solar Run Beaconsfield 0 0 0 6 Solar Run Bentleigh 0 0 1 0 Solar Run Berwick 1 1 0 1 Solar Run Keysborough 0 0 0 5 Solar Run Kilmore 0 0 0 7 Solar Run Langwarrin 1 3 0 2 Solar Run Lara 0 2 0 12 Solar Run Ringwood 0 3 0 1 Solar Run Traralgon 1 1 0 0 Solar Run Warrnambool 0 0 0 2 Solar Run Whittlesea 0 0 0 1 Solar Run Wollert 0 0 0 2 Solar Run Wyndham Vale 0 0 0 1 Solar Secure 1 0 0 25 SolarSeed 0 0 0 17 Solar Smart Australia 0 0 0 1 Solar Spirit 3 1 0 14 Solar Supermarket Pty Ltd 0 0 0 2 Solar Tech Expert 0 0 0 1 Solar Today 1 0 0 4 Solarvista 0 0 0 1 Solarwise Group 0 0 0 1 Sol Excel Pty Ltd 0 0 0 4 Solstra 0 0 0 3 Soltech Solar 1 5 0 3 Solutions4Solar 0 0 0 4 Solution Solar 1 0 0 24 Sonergy 0 0 0 1 South Beach Solar 0 0 0 1 Southeast Solar Australia 0 0 0 3 SPECIALIZED Solar & Electrical 2 4 0 7 Spot on A/C & Electrical 1 0 0 0 Spot on Sparky 0 0 0 1 SP Solar 0 0 1 1 Stanalec Pty Ltd 0 0 0 2 Star Solar Pty Ltd 1 0 0 0 Start Solar 2 7 0 11 Steen Electrical 1 0 0 0 Steve Thomas Plumbing & Maintenance 0 1 0 0 Stewart Air Conditioning and Plumbing 0 1 0 0 Sun 2 Solar 0 1 0 2 Sunburn Solar 0 1 0 7 SUN CURRENT 1 2 1 23 SunDirect Energy 0 1 0 1 Sunergy Solar 0 0 0 5 Sunflare Solar 0 0 0 2 Sun Group Energy 0 0 0 6 SUNLINE ENERGY 1 9 0 10 Sunlink Renewables 0 0 0 2 Sunny Solar 0 1 0 1 Sun Power Electrics 0 0 0 3 Sunrays Power 0 0 0 1 Sun Rays Solar Australia 0 0 0 4 Sunrise Innovations 0 4 0 48 Sunrise Saves Energy Pty Ltd 0 1 0 0 Sunrise Solar Australia 0 0 0 1 Sunrun Solar Pty Ltd 1 0 0 9 Sunscape Solar 1 0 0 10 Sun Select 1 0 0 10 SunSolar Energy Pty Ltd 1 0 1 56 Suntech Synergy 0 0 0 2 SUNTICK SOLAR 0 0 0 1 Sunworks Eco Plumbing 0 1 0 0 Sunworx Energy 0 1 0 5 Supa Solar 0 1 0 2 Supply Solar 0 0 0 5 Suri & Suri Electrical Pty Ltd 0 0 0 4 SUSTAINABLE ENERGY AUSTRALIA PTY LTD 0 3 0 0 Sustainable Plumbing Solutions Pty Ltd 0 2 0 0 Sustainable Solar Services PTY LTD 0 0 1 1 Switch 2 Solar 0 0 0 2 SWITCHTORENEWABLES 0 0 0 2 t2zero 0 2 0 0 Target Green 0 8 0 2 Target Solar 0 0 0 6 TCK Solar 0 1 0 1 Teaslec Electrical 1 1 0 2 Technaus Solar 1 0 0 5 The Happy Plumber 0 1 0 0 The Haymarket 0 2 0 0 The Heat Shop - Geelong 0 2 0 0 The Hot Water Man 0 1 0 0 The Tap Man 0 2 0 0 Think and Grow Renewable 0 1 0 11 Think Solar 0 0 0 1 Thompson Electrical Solutions 0 0 0 1 Time 4 Solar 0 63 0 0 TIMETOSAVE PTY LTD 0 14 0 0 TIME TO SWITCH 0 3 0 0 TJM Electrical Services 0 0 1 3 Too Hot to Handle Heating & Cooling 0 8 0 0 Total Solar and Electrical 0 1 0 2 Total Solar Solutions Australia 1 6 0 2 Touch Automation 0 0 0 1 Traeger Solar 0 0 0 6 TR Electrical & Solar 0 0 0 1 Trentham Electrical and Solar 0 1 0 3 Tri CT Elec PTY LTD 0 0 0 2 TRIONE ENERGY (AUS) PTY LTD 1 0 0 5 Twin City Electrical & Solar 1 0 0 2 Ultima Energy 0 0 0 5 Ultimate Solar Energy/ RA connect pty ltd 1 5 0 4 Ultinity Power Solutions 0 0 0 1 Uncommon Solar 1 1 0 2 Unified Energy Services 4 2 1 27 Unique Solar Solutions 1 0 0 1 United Energy Group 0 0 0 2 UPowr 0 0 0 2 Upwey Gas Fitting and Plumbing 0 1 0 0 Urban Electrical Services Pty Ltd 1 0 0 2 Vagus Energy Solutions Pty Ltd 0 2 0 1 Variety Solar 2 0 0 5 Velocity Solar 2 2 1 6 Venergy Australia 2 0 0 17 Vertex Solar Energy 0 0 0 1 Viccom Electrical P/L 0 0 0 2 Vicsaver 0 3 0 0 Vic Solar Sytems & EV 0 0 0 1 Victorian Energy Savers 0 0 0 1 VJ Energy Group 0 0 0 2 Volt Solar Australia 0 12 0 0 Vortex Electrical 1 3 0 3 VV Electrical and Solar 0 0 0 1 Wades Horsham 0 6 0 4 Wade Smith Plumbing 0 2 0 0 Waldron Heating Cooling & Hot Water 0 10 0 0 Waldron Solar Solutions 0 0 0 6 Walsh Electrical Refridgeration & Air Conditioning 0 0 0 1 Want a Heat Pump 0 19 0 0 Warrnambool Solar 1 0 0 1 Watters Electrical Pty Ltd 0 5 0 8 WATTS OF POWER 0 0 0 1 Western Elec 0 0 0 1 WILLCO ELECTRICAL 0 0 0 2 Winki Solar 0 0 0 7 WM Solar & Electrical 0 0 0 3 Yarra Solar 0 0 0 1 Your Green Planet 0 0 0 1 ZAP TECH ENERGY 0 0 0 1 ZECO Energy 5 2 0 14 Zed Energy 0 0 0 3 Zero Energy Australia 0 3 0 1 Zing Solar Vic 0 0 0 4 Zip Solar 0 0 0 19 Total 235 2451 54 2849

Past programs

These programs closed after successfully supporting many more Victorians to participate in the renewable energy transition.

The Home Heating and Cooling Upgrades program was designed to support up to 250,000 low-income Victorian households with the upfront cost of replacing their outdated, unsafe, or inefficient electric, gas or wood-fired heaters with an efficient electric reverse cycle air conditioners (RCACs).

Investing in energy-efficient heating and cooling can help households stay warm and comfortable while minimising energy costs. For more information, see our guide to heating and cooling.

Opened: Announced in September 2020.

Closed: 30 December 2022.

Key outcomes:

- 34,920 applications approved and 28,905 installations completed.

- supported vulnerable and low-income Victorians living in social housing, with a total of 11,421 installations completed in community and public housing. Community Housing Organisations installed 1,955 RCACs and a further 9,466 RCACs were installed at public housing properties.

- Over 150 approved suppliers delivered upgrades through the program and Solar Victoria delivered targeted capability building training to almost 30 suppliers.

- 474 products were registered as eligible to be installed through the program, meeting safety, energy efficiency, climate friendly and demand response criteria, reducing the running costs for households.

- 65.9% of installations were in metropolitan Melbourne, and 34.1% in regional Victoria. The highest number of installations were in Casey, Greater Geelong, and Monash local government areas.

The Victorian Government’s target is for half of all light vehicle sales in Victoria to be Zero Emissions Vehicles (ZEVs) by 2030. Its Zero Emissions Vehicle Roadmap delivers the long-term vision to roll out this key driver of our clean energy future.

The ZEV subsidy program was designed to help accelerate the uptake of ZEVs, encourage more ZEV models into the Victorian market, and make them more affordable for Victorian customers.

ZEVs are an important step in Victoria’s transition to a clean energy future. See our zero emissions vehicles facts to learn more about ZEVs.

Opened: Announced on 1 May 2021 and opened on 2 May 2021.

Closed: 30 June 2023 (expected delivery timeline).

Key outcomes:

- 9,927 subsidies delivered.

- Victoria’s ZEV market share increased from 1.8% of new light vehicle sales in 2021 (date of program launch) to 7.2% of sales (12-month rolling average as of October 2023).

- Supply of eligible models steadily increased over the lifetime of the program from 11 models from 6 manufacturers in July 2021 (when applications opened) to 22 models from 13 manufacturers in June 2023 when the program closed to new applications.

The Solar for Business program was designed as a three-year economic stimulus measure, supporting businesses during a time of highest need and financial uncertainty, and as part of the Victorian Government’s investment in renewable energy measures.

Opened: May 2021.

Closed: 30 June 2023 (expected delivery timeline).

Key outcomes:

- 3,654 rebate applications approved and 1,398 loans established (47.7% of applicants following the introduction of loans to the program).

- Main businesses participating in the program included cafes and restaurants, automotive repair and maintenance, electrical services, accommodation, medical services, takeaway food services, and dental services.

- Top installation suburbs included Campbellfield, Dandenong South, Cheltenham, Truganina, Thomastown, Carrum Downs, and Epping.

Updated